Guarantee of regular income for lifetime

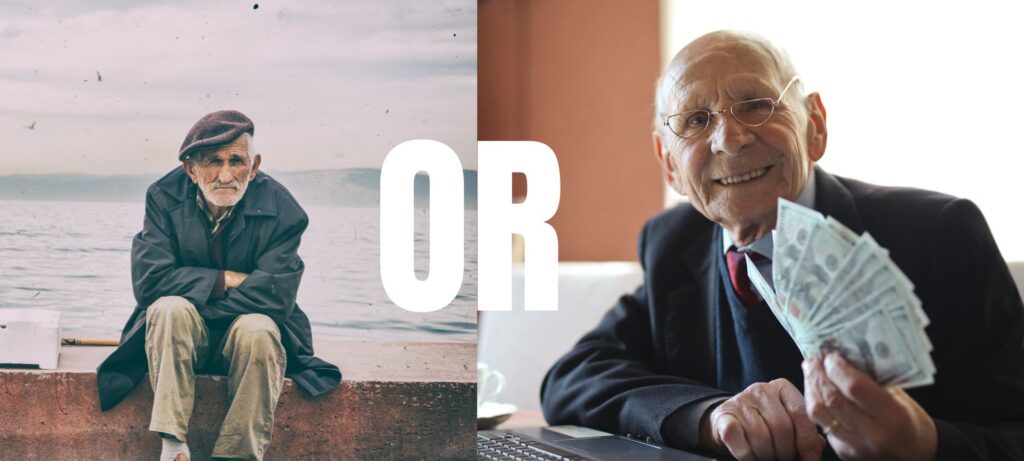

We are talking about a life-long guaranteed tax-free income. Think of a time 15 years, 20 years, 25 years, or 30 years from now when you will retire and stop earning an active income but still on the 1st of every month a guaranteed sum of money gets deposited to your bank account that is tax-free* and would continue up to 99 years of your life. How relaxing does this situation feel?

And that is not all, at the same when you are earning a guaranteed, tax-free* amount you are also creating an estate for your family that keeps growing year after year which is handed over to your family after you. Most importantly you can choose the amount of guaranteed pension you need every year and create it accordingly.

Think of it as,

- a big FD (fixed deposit) that you have created with easy installments and

- from which you are earning a guaranteed, tax-free* regular income of your choice for lifetime, and

- the FD rate is fixed for lifetime and are not getting lower with time, and

- at the same time the deposit is growing every year till your age of 99 years, moreover

- you have the choice of stopping the FD at any time get lumpsum cash and stop getting payouts or to keep it as a legacy for your nominee.

Amazing, right?

And additionally, we have the freedom to create the deposit through monthly, quarterly, half-yearly, or yearly contributions for a period of time, and the income is fixed accordingly. You have to choose the duration of contributions keeping in mind your income needs both in terms of amount and time to retire as well as your capacity to contribute at present.

Example of contribution & income

We take an example of a yearly contribution of 10 lakhs made by a person of 30 years of age for different contribution periods.

| Yearly Contribution | Years Contributed | Guaranteed lifelong payout. (post contribution) | Additional Estate created# (shown at age 100) |

| 10 Lakhs | 15 | 10 Lakhs | 15 Crores |

| 10 Lakhs | 20 | 15 Lakhs | 21 Crores |

| 10 Lakhs | 25 | 20 Lakhs | 28 Crores |

| 10 Lakhs | 30 | 25 Lakhs | 36 Crores |

# Values are approximate and expected as per present calculations of bonuses.

What is this plan?

This plan is a reality and is a whole life plan offered by Life Insurance Corporation of India and comes with a Sovereign Guarantee (LIC policyholders enjoy a sovereign guarantee on the sum assured and the bonus declared as per section 37 of LIC Act, 1956 which clearly states that ” Policies to be guaranteed by Central Government- The sum assured by all policies issued by the corporation including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities under which have vested in the corporation under this act, and all bonuses declared in respect thereof, whether before or after the appointed day, shall be guaranteed as to payment in cash by the Central Government.”).

No plan is comparable to this one, which gives guaranteed, lifetime, tax-free* payouts along with the creation of a growing family fund.

Benefits for the holder

1. Lifetime guaranteed income

Get lifetime guaranteed income every year post the premium term @ 8% of Sum Assured. Can be availed as monthly payout as well.

2. Increasing life cover

Get increasing life cover till age 100, to address growing insurance needs with age. Option to surrender and get the cash value anytime during payout period or leave a legacy for your nominee.

3. Assured capital protection

Get assured capital protection with Sovereign Guarantee of LIC as per section 37 of LIC Act, 1956. No other companies in India can provide you with this assurance.

4. Pre-sanctioned loan and liquidity

Get liquidity for unprecedented cash requirements during the premium paying term, through pre-sanctioned loan facility. No income documents or credit ratings required to avail this loan.

5. Double accident Insurance cover

Get Accidental Insurance cover double the basic life cover. In case of death of policyholder due to accident, nominee gets double the basic sum assured.

6. Disability Benefit: income support for 10 long years

Get Disability Benefit equal to the Accident Benefit Sum Assured. In case of a total permanent disability the amount is divided into equal monthly instalments spread over a period of 10 years as income replacement. Also, payment of future premiums is also waived.

7. Tax-free* income

Unlike a pension, this yearly payout for lifetime is tax-free. * As per current tax rules the yearly payout is tax-free if total premium paid is below 5 lakhs in a year. Total premium is calculated across all insurance products of all insurers.

Can NRIs avail benefits of this plan?

NRIs are also allowed to contribute and reap the benefits of this plan and create life-long guaranteed tax-free income. (with restriction on sum assured depending on the country of residence). They can apply for these benefits when they visit India. Else, they can invest through the regulation called “Mail Order Business” from their current residential country. They would, however, have to complete certain formalities. Contact us for details.

Disclaimer: The information provided in this blog is for general informational purposes only and does not constitute professional advice. While full efforts have been made to ensure the accuracy of data and numbers, no responsibility is taken for any errors or omissions. Tax implications on insurance, investments and returns from related products may change due to updates in tax laws. Always consult with your financial advisor or insurance expert before making any investment or insurance decisions. The author is not responsible for any financial losses or damages incurred as a result of relying on the information in this blog.