Planning a dignified life after 60. How and why, it is important? These 5 minutes of your life that you’ll spend reading this post might help you shape 25 years of your life.

This is March 2022 and I hope you are aware that at the current rate of inflation the expenses of Rs 50,000 per month today will be 1,60,000 per month after 20 years. Even if you leave aside the current rates, would you agree that, due to inflation, a monthly survival expense of 50,000 today would possibly be 1,00,000 in the coming 20 years?

Choosing a post-retirement life

You would still be able to cope with your expenses while you are earning i.e. up to your retirement age. But, what about the expenses after your retirement? After your retirement, your active income would stop but your life’s expenses will not and would further increase year on year. You have got 3 options on how you choose to live your retired life:

Option 1.

Be compelled to work even beyond your retirement age for earning money to meet your expenses

Option 2.

Be dependent on society or your son/daughter, for not being able to create enough passive income to survive on your own, and

Option 3.

Plan and create a retirement fund and regular income system that will enable you to live an independent, happy, and stress-free retired life.

Which one would you like to choose? Of course, the 3rd option, right? You are living a life of giving, and providing for your family and would surely like to continue with the same life of dignity. It would be a pity if you and your spouse have to depend on and take from your son/daughter for survival after your retirement.

Facts

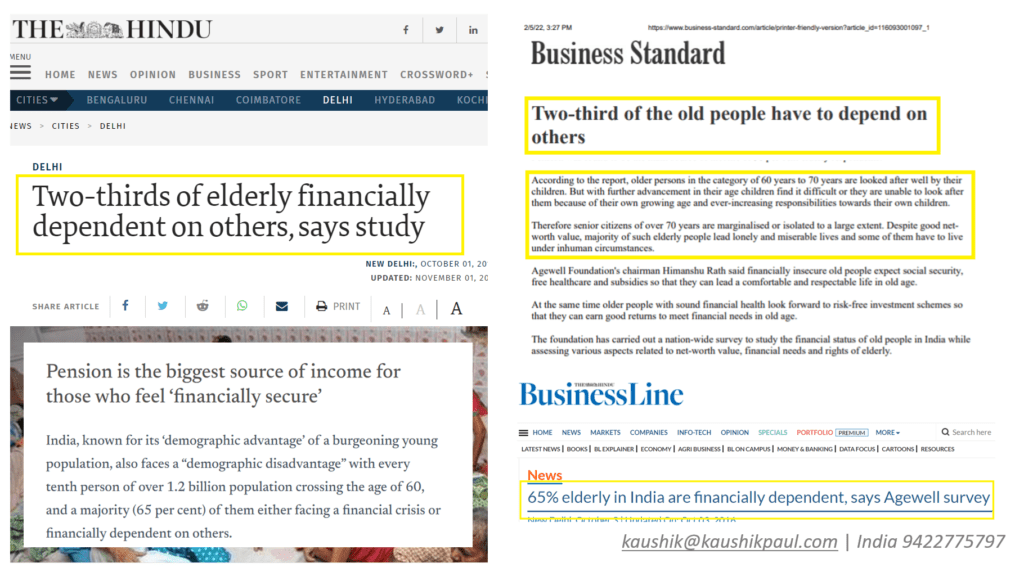

If you still feel that this is something trivial, here, I will share with you the fact that in India around 63% of the population above the age of 60 are dependent on other people, on their children, or on society and leading a miserable life (with limited or no freedom). No need to say that this 63% includes people from all income groups and occupation backgrounds.

Do you have a retirement plan in place?

Do you have a retirement plan in place so that you can live your retirement life (probably another 20-30 years beyond your retirement) with the same respect and dignity?

If you have already started saving and investing for your retirement, great, just do a check-up whether everything is planned well and are on track. If you have not thought of it seriously yet, it’s high time you take a firm first step. Because, whether you want it or not, it is going to arrive. Take some effort ‘today’ for the most important financial plan of your life. It is never too early to plan for your retirement.

Remember, you can avail of a loan for all your financial goals but not for your retirement.

Why not to delay?

You might still feel that you have so many years to accumulate money and with the increase in your income in the coming years you can easily create something that will last your whole life. But, there are a few issues:

Issue 1.

With the increase in your income your survival and lifestyle expenses will also increase, and you might end up with a similar financial situation as today as far as surplus money is concerned.

Issue 2.

It is very difficult to create huge funds even with a higher sum of periodic investments if the time horizon is low, and

Issue 3.

With interest rates decreasing, (20-25 years from now it will probably be 1% or less) you will need a huge corpus in the future to generate a monthly income that can cater to your then monthly expenses.

Today, even if you have a minimum amount to save, do it. Do not wait for that huge monthly surplus to happen in your life to start saving (and investing) for your retired life.

How to arrive at a number?

Now, how much future retirement corpus you would need, how to achieve that amount, which instruments to use, how much to invest in each instrument, and till what period you should stay invested, all these will vary from person to person with factors like age, requirement, risk appetite, mindset, and current financial capacity.

Do not delay your plans. You can create greater funds with smaller investments if you give that investment enough time to grow big, and a year of delay can cost you lakhs. Reach out to a financial advisor today.

If you would like your friends to know about this you are welcome to share this post with them as well.

Disclaimer: The information provided in this blog is for general informational purposes only and does not constitute professional advice. While full efforts have been made to ensure the accuracy of data and numbers, no responsibility is taken for any errors or omissions. Tax implications on insurance, investments and returns from related products may change due to updates in tax laws. Always consult with your financial advisor or insurance expert before making any investment or insurance decisions. The author is not responsible for any financial losses or damages incurred as a result of relying on the information in this blog.